Table of Content

The gentlemen who helped us were very nice and considerate and answered all of our questions. New or used - we offer the same low rates on the sea or on the lake. A great rate and a great value with a loan designed for classic cars.

I strongly recommend DCU for all your banking. Many factors go into determining the final loan amount for the purchase of a new or used vehicle. These factors include any manufacturer's rebate, the trade-in value of your old vehicle less any outstanding balance, your down payment, etc. The timeline for application and funding can vary, depending on how quickly the required documentation is provided.

Where can I find information about my vehicle title?

I'd consider a Personal Line of Credit if they offered it, but don't need or want a personal loan. Actually , they are also using Teams without any problems. The Jabra Evolve2 65 Wireless are more versatile than the Plantronics Voyager 5200 Bluetooth Headset, though they're radically different devices with different intended uses. The Jabra are Bluetooth stereo headphones with a better-balanced sound profile, much longer battery life, a broader range of configuration options, and a superior boom.

I accepted the offer this morning and got a one line response that I clicked away from before fully comprehending. I'm trying to position myself to have a bit more low interest CL available for when my kitchen stuff comes off 0% in the spring. I'll likely be able to get it back onto 0%, but I want a bit more breathing room of under 10%/no BT Fees in case it's necessary. From what I have read if dcu has an offer for u it's a soft pull. Let us help you save money on your next car or the one you already drive today.

Applying for Your DFCU Mortgage

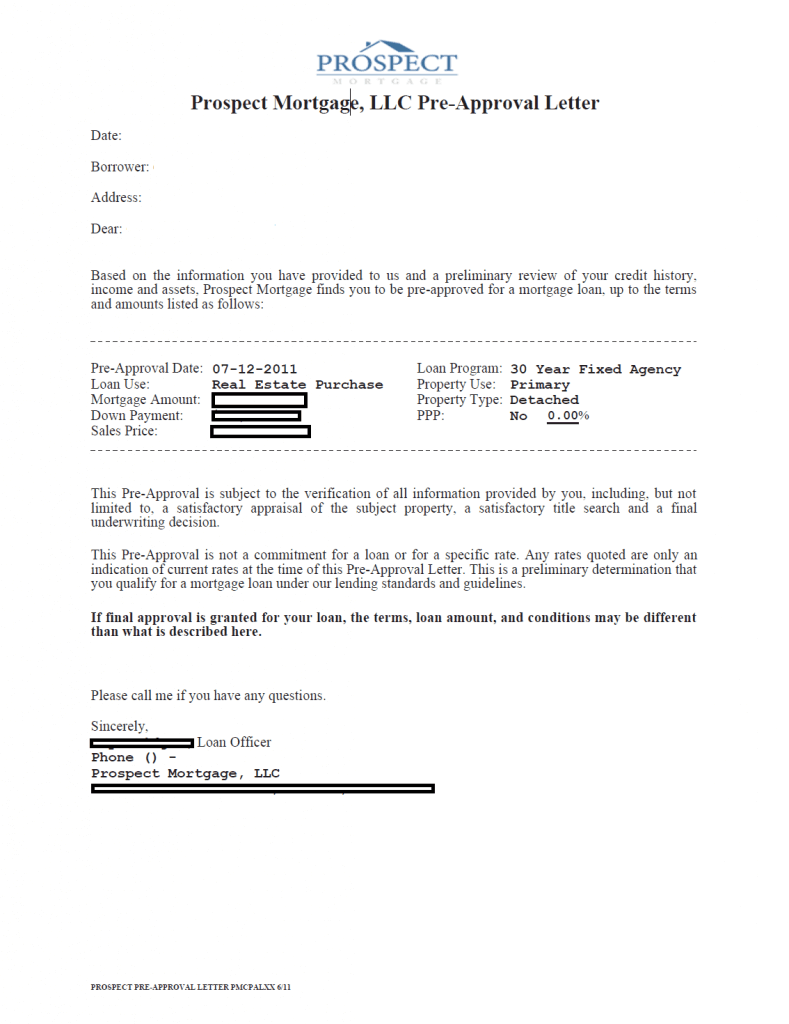

While a pre-approval does not always guarantee a faster application, it is more likely to inspire vendors to accept any offers you might place. Look at your budget to see what monthly payment you can handle, bearing in mind any changes you may have in insurance, maintenance, and fuel costs. Plug your ideal monthly payment into an online car-buying calculator to find out how much of a car you can afford, taking projected trade-in value, or down-payment money into account. There are several reasons you may consider refinancing your home. You may be able to lower your interest rate, reduce your payments, change the term of your loan term, or even tap into the equity of your home.

Your dream home is still out there, and prequalification can get you one step closer – helping you make a strong offer when you find it. Contact a Mortgage Loan Originator for help completing an application. Frequently asked questions and answers to help manage and plan for your mortgage. You have a family relationship to a non-member who belongs to an organization in our list of participating organizations. Relatives of DCU members are eligible to join if they are spouses, domestic partners, children grandchildren, parents, grandparents or siblings (including adoptive in-law, and step relationships). Helpful resources and tools to assist with your home buying process.

Home Loan Pre-Approval Explained

If your loan application is denied post pre-approval it may be best to withhold from immediately placing another application. Each time you apply for pre-approval, or a loan, this will be marked on your credit report as an enquiry. Frequent enquiries may be considered a red flag by lenders. A pre-approval that includes a bank assessment is likely to provide you with a more concrete estimation of your borrowing power.

I think you got good chances of getting approved. DCU Insurance helps you achieve financial well-being by protecting your most valuable personal assets – home, car, and earnings – from the ever-present, serious threat of property and liability losses. We treat you the way DCU members expect to be treated. We provide you top quality products from great insurers, fair prices, outstanding service, and member education. Typically, lenders have a “maximum LTV” threshold in place which determines how much of a loan they are willing to finance for a vehicle based on its value. As you may imagine, on-time payments will result in a higher score, while late payments and collection accounts will damage your score.

Best rates and service

Default figures shown are hypothetical and may not be applicable to your individual situation. Calculation results does not indicate whether you qualify for a loan or assumes you could qualify for the loan, product or service. The calculations provided should not be construed as financial, legal or tax advice. Consult a financial professional prior to relying on the results presented. Calculation results does not indicate whether you qualify or assumes you could qualify for the loan, product or service. You must be a member and open an account in order to apply for an auto loan and not everyone will qualify for membership.

Whether your dream car is new or just new-to-you, DCU's auto loans make it easy to hit the road by offering low rates and flexible terms. A cash out refinance allows you to tap into the equity in your home. After you close, you’ll receive a check for the difference between your current mortgage payoff + closing costs and your loan amount. A rate and term refinance changes your interest rate and/or the term of your mortgage, typically loan amount remains the same unless you wish to roll closing costs in. Loan to value is the ratio that compares the amount of a loan against the value of the vehicle.

You are about to enter a website hosted by an organization separate from DCU. Privacy and security policies of DCU will not apply once you leave our site. We encourage you to read and evaluate the privacy policy and level of security of any site you visit when you enter the site. While we strive to only link you to companies and organizations that we feel offer useful information, DCU does not directly support nor guarantee claims made by these sites. It is provided as a self-help tool for your independent use.

While you must become a member, which includes opening an account, to obtain an auto loan, DCU checking accounts have no minimum balance, no monthly maintenance fees and unlimited check writing. In addition, DCU also offers its members a free notary service, online storage and even a prescription discount card. In addition, DCU could also be on the list of possible lenders for those looking to purchase some kind of specialty vehicle, since it offers a wide range of those types of loans.

No comments:

Post a Comment